Category: Markets

Markets

Economics Cannot Trump Mathematics

Originally posted at Monty Pelerin’s World blog [4],

It is nearly impossible to convince people that an economic ending is likely, perhaps inevitable. It is beyond anything they have seen or can imagine. I attribute that to a normalcy bias, an inherent weakness of experiential learners. For many, accepting something that has not occurred during their time on the planet is not possible. The laws of economics and mathematics may shape history but they are not controlled by history.

The form of cataclysm and its timing is indeterminable. Political decisions continue to shape both. The madmen who are responsible for the coming disaster continue to behave as if they can manage to avoid it. Violating Einstein’s definition of insanity, they continue to apply the same poison that caused the problem. These fools believe they can manage complexities they do not understand. We are bigger fools for providing them the authority to indulge their hubris and wreak such damage.

Apocalypse In One Picture

James Quinn [5] provided the following graph. If a picture is worth a thousand words, this graph is worth millions. The route to economic demise is depicted below:

[6]

[6]

The relationships in this graph are terrifying! Debt is shown relative to GDP. GDP growth has been one-third the growth in debt for the period. That is, the economy required $3 of debt to produce $1 more in real GDP. In recent years diminishing returns to debt required $6 of debt to increase GDP a $1. Whatever the benefits of debt, they have clearly diminished, almost to zero. Debt expansion has gone exponential in order to salvage the weak growth in GDP.

To put this into a perspective the average reader can understand, think of GDP as a household’s spending. The “family” depicted above has to borrow each year in order to maintain its spending level. Imagine the condition of your family if you borrow ed 6 times the amount of incremental spending each year. Then imagine the condition of your family after forty years of continuously increasing your debt levels substantially in excess of your income.

It is impossible for a family without a printing press and a cooperative Federal Reserve to engage in such behavior. The government is different, you say? Surely it is, but not necessarily in a meaningful financial manner. Just as you would not survive such behavior, governments cannot either. History is full of examples of government collapses resulting from excessive debt and overspending. A printing press only provides the luxury of more time before the failure. [7]

[7]

You may object that a macroeconomy is different from a family. Debt (parroting the political claim) makes an economy grow faster. The evidence shown to the right does not support this claim. Government reported GDP growth rates are shrinking as the debt expansion accelerates. Since 1965 the growth rate of the economy has been declining.

Even if you accept government GDP reporting, the chart to the right shows a trend this is pointing to an average declining standard of living. That point will be reached when the GDP growth falls below the population growth.

The US economy has been underperforming since the 1970s according to government’s statistics. That is after all the games have been played with these numbers. How much longer can these trends continue and what happens at the end? No one can reasonably answer either of these questions.

What Is Known And Not Known

Two things are known:

- So long as borrowing increases faster than GDP, the ability to repay diminishes. That has been occurring for more than forty years and the differential growth rates have widened dramatically in recent years.

- Not borrowing at this pace would likely have decreased reported GDP dramatically. While that may have been a proper economic response, it is now politically impossible (or highly unlikely).

Continuing to increase debt at a rate greater than GDP ensures financial collapse. Stopping or slowing down at this point likely leads to the same point. This country has maneuvered itself into a no-escape situation.

What would happen to GDP and the standard of living if borrowing were dramatically reduced? How much of the last $10 trillion in debt borrowed between 2000 and 2009 went directly into reported GDP? Is it possible that reported GDP for this period could have been $10 trillion lower? If there is indeed a monetary/fiscal multiplier as Keynesians insist, then results would have been worse.

Answers to these questions are speculative. Those in favor of more debt argue that a calamity would have occurred had the massive rise in debt and its accompany stimulative effects not happened. For the Paul Krugmans of the world, more debt and stimulus is always the answer. All problems look like nails when you own only a hammer.

Rapidly increasing amounts of debt since 1965 have been accompanied by falling rates of growth. One may speculate what this growth would have been with different rates of debt expansion. Whether the rate of debt expansion increased or decreased the rate of real GDP is moot. Economists can use their competing paradigms to duel over this issue, but cannot come to a conclusion that is acceptable to most.

Mathematics, on the other hand, is definitive. There are mathematical limits that control the ability to service debt. Once these limits have been breached, some amount of the debt will be defaulted on. The breach point is referred to as a debt death spiral. The US has passed this mathematical point and is in a death spiral.

The political class in America, either via misguided economic policies or a deliberate attempt to hide the true condition of the country, has put us here. They will continue to employ whatever policies they believe will keep things going for a while longer. The tragic ending has been cast. Economics cannot trump mathematics.

https://www.zerohedge.com/print/476917

Detroit’s Fallout: Muni Illiquidity And Full-Faith-And-Credit Failure

market is almost non-existent.

Municipal finance is in sharp focus after Detroit filed the largest municipal bankruptcy in history and with analyst Whitney warning of more to come. At the moment, Detroit’s (relatively small) $18 billion in GO (general obligation) bonds have had few ripple effects on the $3.7 trillion US municipal market, or on the $100 trillion of global fixed income securities. However, this bankruptcy could eventually lead to significant reappraisals of credit risk, higher funding costs, and legal precedents pertaining to debt creditors and pension ‘guarantees’.

Many fiscal stresses have roots originating from the duplicitous incentive system of elected officials who over the past several decades promised future perks to state and local public employees, but who leave the fulfillment of those promises to successor governors or mayors. In New Jersey for instance, Governor Chris Christie inherited an underfunded pension, mostly caused by 22 years in a row of preceding Governors not paying into the pension system the full amount allocated in the State’s annual budget. Part of Christie’s high popularity in NJ and across the US is due to his plan to save the pension system – a plan that passed the state legislature with bi-partisan support.

Most US cities and states have not made much progress in addressing the legacies of those future promises. Making matters worse is the fact that municipal finances (in recent years) have run deficits despite constitutions that require balanced budgets. Reduced federal subsidies and low economic growth rates after the 2008 financial crisis have further impaired budgets. To bridge the gap, spending cuts are often made to basic social services such as education, road and park maintenance, infrastructure projects, or police and fire. Cuts to pensions or bond creditors are typically skirted due to legal protections.

Michigan’s governor appointed an emergency manager who proposes paying Detroit’s GO bondholders less than 20 cents on the dollar. As for the pensioners, the state constitution refers to accrued pension benefits as “contractual obligations which shall not be diminished or impaired”; yet, with a $9 billion underfunded gap, pensioners expect cuts. At some point, a judge is likely to make a ruling on the legality of cuts to creditors or pensions which could have an impact on market premiums and other public pensions. (The PEW Research Center estimates US pension underfunding as high as $3 trillion).

GO bonds are viewed as relatively safe securities because they are seen as being in the first lean position and ‘guaranteed’ by the taxing authority of the municipality. When problems develop, cuts in services happen, even as taxes rise. The combination drives out residents and businesses. The erosion to basic social services often leads to drops in home values and rising crime, further setting off a negative feedback loop. Therefore, the ability to tax or cut service has its limitations and should not be seen as a solution to ‘guarantee’ creditors, because they destructively undermine the sustainability of the city or state.

The global hunt for yield has probably chased new investors into the Muni market who may not fully understand that in recent years it has become an ‘ownership not rental’ market. In other words, it is unlikely holders of Munis can sell what they own, as liquidity in the secondary market is almost non-existent.

The Detroit bankruptcy filing is no surprise, given that its financial distress can be traced as far back as 1992, when Moody’s downgraded the City’s debt to junk. While ratings did bounce back to IG levels for brief periods, the City has essentially faced worsening budget deficits and liquidity challenges over the last decade.

The Detroit Emergency Manager’s proposal for creditors was unprecedented, at least as far as municipals are concerned, as it essentially tried to flatten the debt priority structure by attempting to impose the same treatment for GO bonds as other forms of debt which are deemed unsecured, including pension obligations, OPEBs, leases and COPs.

The Emergency Manager’s restructuring plan was unlikely to succeed via bilateral agreements and just on the face of it, the Chapter 9 filing could be viewed as mild positive for GO bond holders (especially unlimited GO bondholders) as now more control rests with the bankruptcy judge and standard Chapter 9 rules could apply.

However, the Emergency Manager retains the exclusive rights to file an adjustment plan (unlike Chapter 11, there is no provision in Chapter 9 for creditors to end this exclusivity or propose a competing plan). Thus, the original restructuring plan could serve a baseline for the ultimate settlement and recovery process.

It is still early in the process to predict recovery rates but the unlimited tax GO bond structure provides creditors with a stronger lien on the issuer’s resources and thus recovery rates on this class of debt could be somewhat higher vs. limited tax GOs and other forms of debt which are deemed unsecured. Again, it’s early in the process and there is no precedent for a large city with this level of financial distress.

Detroit’s filing is an isolated case and its fiscal problems are not indicative of the broader municipal credit landscape, in our view. But, the outcome of the bankruptcy process will dictate whether the value of the full faith and credit pledge backing GO bonds will be diminished going forward.

https://www.zerohedge.com/print/476855

Continue ReadingFeds tell Web firms to turn over user account passwords

The U.S. government has demanded that major Internet companies divulge users’ stored passwords, according to two industry sources familiar with these orders, which represent an escalation in surveillance techniques that has not previously been disclose…

Continue ReadingGoldman And JPMorgan Probed Over Metals Warehouse Manipulations

Following our initial uncovering of the manipulation and monopolization of the metals warehousing business two years ago, the last few days have seen the public’s attention grabbed by the reality of what the banks are actually doing. Fol…

Continue ReadingThe Edifice of “Recovery” is Crumbling

Rising food prices, climate change and global ‘unrest’

Niall BradleySott.netSat, 20 Jul 2013 12:53 CDTI don’t mean to put a damper on the everyone’s summer holidays, but the current heatwaves in the U.S. and Europe has me thinking back to numerous warnings issued during last summer’s major drought and “rec…

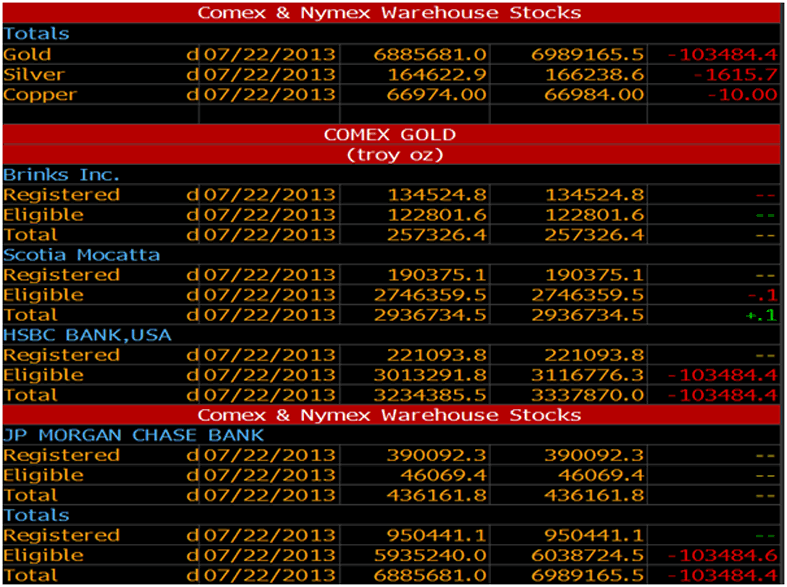

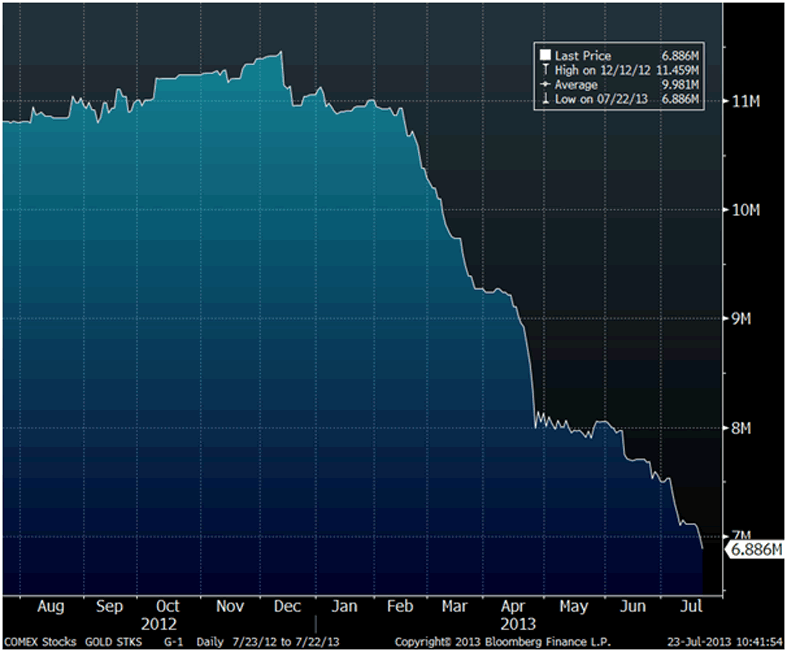

Continue ReadingGold Surges As COMEX Default May Send Gold Price Over $3,500

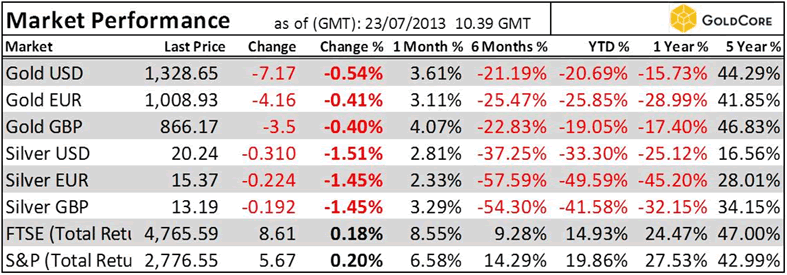

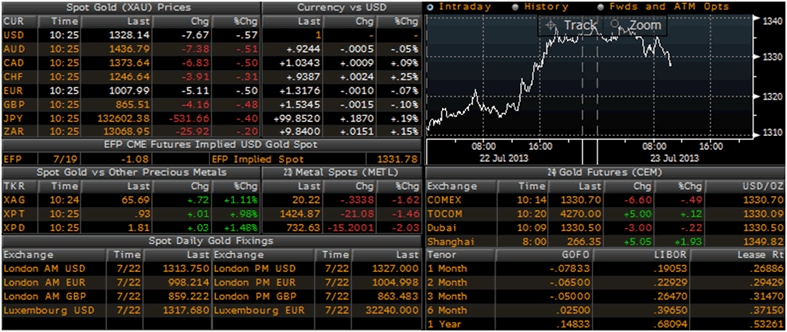

Today’s AM fix was USD 1,326.75, EUR 1,007.10 and GBP 864.84 per ounce.

‘GoldNomics’ can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

Why Cybersecurity Stocks Are One of the Best Investments You Can Make Right Now

Tara Clarke writes: or months now, we’ve been harping to our readers about why cybersecurity is one of the absolute best investments you can get involved with right now.Now the rest of the financial media is catching on.This weekend, Barron’s profiled …

Continue ReadingSEC Charges Texas Man With Running Bitcoin-Denominated Ponzi Scheme

2013-132