Category: Financial System

Financial System

EES: Tradestation a great option for US Forex traders

US based Forex traders still have a great option to trade Forex with automated systems – Tradestation. Tradestation EasyLanguage is simple to code your automated system. Forex accounts funded with $2,000 have no platform fee!

TradeStation- Trade with the online broker ranked best by Barron’s – Open an account today!

EES: Russia and China to impact Forex market dynamics

In response to sanctions, Russia is seeking non-USD trade deals, most notably with China. How will non-USD transactions impact the Forex market? Already, US based intellectuals are calling for an end to the Dollar Hegemony:

Note that as long as the dollar is the reserve currency, America’s trade deficit can worsen even when we’re not directly in on the trade. Suppose South Korea runs a surplus with Brazil. By storing its surplus export revenues in Treasury bonds, South Korea nudges up the relative value of the dollar against our competitors’ currencies, and our trade deficit increases, even though the original transaction had nothing to do with the United States.This isn’t just a matter of one academic writing one article. Mr. Austin’s analysis builds off work by the economist Michael Pettis and, notably, by the former Federal Reserve chairman Ben S. Bernanke.

Russia and China are agreeing to settle more trade in Rubles and Yuan. From Reuters:

(Reuters) – Russia and China pledged on Tuesday to settle more bilateral trade in rouble and yuan and to enhance cooperation between banks, Russia’s First Deputy Prime Minister Igor Shuvalov said, as Moscow seeks to cushion the effects of Western economic sanctions. Shuvalov told reporters in Beijing that he had agreed an economic cooperation pact with China’s Vice Premier Zhang Gaoli that included boosting use of the rouble and yuan for trade transactions. The pact also lets Russian banks set up accounts with Chinese banks, and makes provisions for Russian companies to seek loans from Chinese firms. “We are not going to break old contracts, most of which were denominated in dollars,” Shuvalov said through an interpreter. “But, we’re going to encourage companies from the two countries to settle more in localcurrencies, to avoid using a currency from a third country.”

China has an explosive Forex market, and is negotiating swap arrangements with other central banks. Retail demand for Forex in China is also exploding. Although the US Forex market is not developed as in Europe, Asia, and the UK, the USD has been the global reserve currency since World War 2. How will new players such as Russia and China impact the Forex market, and values of other currencies? Certainly, they will not take the same view as the US.

The free-floating Forex system we have today was in fact created by the US (Nixon Shock) but since no standards were ever established, now it’s an unknown unknown how the BRICs will evolve the Forex market, but certainly it will be changed forever. And certainly we can expect extreme volatility in the years ahead, even on the majors.

Continue ReadingGIH: US or Non-US

The most commonly used introduction in any Forex business for the past 3 years: “US or Non-US” As much of the world moves to a non-USD Forex system, it is becoming ever more difficult for US citizens to trade Forex. Since the dud-fag regulations that have protected the US consumer from opening accounts offering 400:1 […]

Continue ReadingInterbank FX transfers MT4 accounts to FXCM

Dear valued client,

As you may already have heard, TradeStation has announced an agreement between its IBFX, Inc. and IBFX Australia Pty Ltd subsidiaries, and a subsidiary of FXCM Inc., in which all retail accounts in the “MetaTrader/MT4” division of both IBFX forex subsidiaries will be transferred to FXCM.

Having supported two forex business lines – MT4 and TradeStation – for some time, we have now decided to focus solely on our TradeStation Forex platform offering.

TradeStation’s success over the past 15 years is due in large part to the unique, differentiating features and functions offered by the TradeStation platform, and this move will enable us to focus our resources on continuing that success.

This change will not affect your TradeStation Forex account(s). Should you have any questions, please contact us.

Sincerely yours,

Gary Weiss,

President of IBFX, Inc.

De-Dollarization Continues: China-Argentina Agree Currency Swap, Will Trade In Yuan

Argentina, which defaulted on its debt in July, will receive the first tranche of a multi-billion dollar currency swap operation with China’s central bank before the end of this year, the South American country’s La Nacion newspaper reported on Sunday.The swap will allow Argentina to bolster its foreign reserves or pay for Chinese imports with the yuan currency at a time weak export revenues and an ailing currency have put the Latin American nation’s foreign reserves under intense pressure.La Nacion said Argentina would receive yuan worth $1 billion by the end of 2014, the first payment of a loan worth a total $11 billion signed by Argentina’s President Cristina Fernandez and her Chinese counterpart in July.

Continue ReadingPeople’s Bank of China Governor Zhou Xiaochuan expressed his support for Argentina in its legal fight against holdout bondholders

EES: Snap up .cash and .fund for your investment business

FX System Hosting now offering .cash .tax and .fund top level domains for your investment related website.Get a .cash for your Forex company, Forex managed accounts program or signal service, or other financial business. Order one at www.fxsyste…

Continue ReadingIn Shocking Move, ECB Cuts By 10 Bps, Sends Deposit Rate Further Into Negative Territory

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

- The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.05%, starting from the operation to be settled on 10 September 2014.

- The interest rate on the marginal lending facility will be decreased by 10 basis points to 0.30%, with effect from 10 September 2014.

- The interest rate on the deposit facility will be decreased by 10 basis points to -0.20%, with effect from 10 September 2014.

The President of the ECB will comment on the considerations underlying these decisions at a press conference starting at 2.30 p.m. CET today.

Trade the Euro – Open a Forex Account

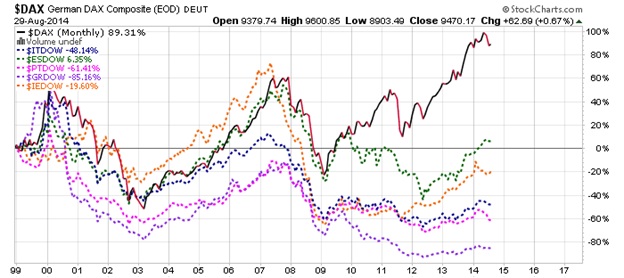

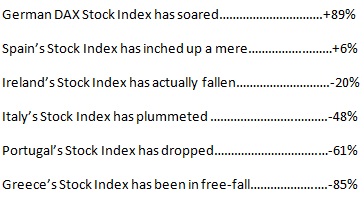

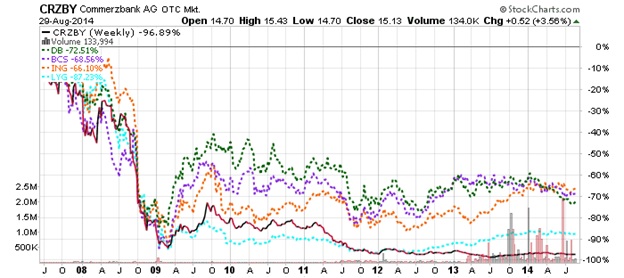

The Ultimate Demise Of The Euro Union

The Nail In The Petrodollar Coffin: Gazprom Begins Accepting Payment For Oil In Ruble, Yuan

The Russian government and several of the country’s largest exporters have widely discussed the possibility of accepting payments in rubles for oil exports. Last week, Russia began to ship oil from the Novoportovskoye field to Europe by sea. Two oil tankers are expected to arrive in Europe in September.According to Kommersant, the payment for these shipments will be received in rubles.Gazprom Neft will not only accept payments in rubles; subsequent transfers via the ESPO may be paid for in yuan, the newspaper reported.According to the newspaper, the change in currency was made because of the Western sanctions against Russia.As a protective measure, Russia decided to avoid making its payments in US dollars, which can be tracked and controlled by the United States government, Kommersant reported.

The New New Normal flow of funds:

- Gazprom delivering gas to China.

- China Gazprom paying in Yuan (convertible into Rubles)

- Gazprom funding itself increasingly in Yuan.

- Russia buying Chinese goods and services in Yuan (convertible into Rubles)

And all of this with the US banker cartel completely disintermediated courtesy of the glaring absence of the USD in any of the above listed steps, or as some may call it: from the Petrodollar to the Gas-o-yuan (something 40 central banks have already figured out… just not the Fed).

In retrospect it will be very fitting that the crowning legacy of Obama’s disastrous reign, both domestically and certainly internationally, will be to force the world’s key ascendent superpowers (we certainly don’t envision broke, insolvent Europe among them) to drop the Petrodollar and end the reserve status of the US currency.